Stay Ahead of Changing Tax Requirements for 2017

There have been some recent changes to filing deadlines and requirements that we want to share with our clients and colleagues.

Federal Changes

Starting in 2017, the IRS has published new accelerated deadlines for filing W-2s and 1099s as an attempt to reduce identity theft and fraudulent refund claims.

2016 Form W-2, W-3 and 1099s showing an entry in Box 7 (non-employee compensation) must be filed by January 31, 2017.

1099s not showing entries in Box 7 are due February 28, 2017 if filed on paper and by March 31, 2017 if filed electronically.

Many states have changed their filing deadlines to match the federal however Arizona’s due date remains February 28, 2017.

Arizona Changes

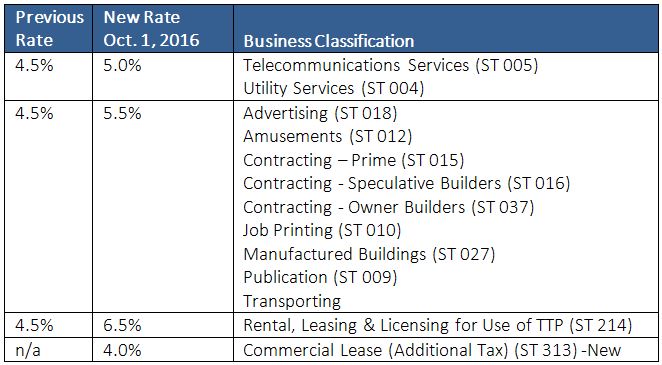

On July 28, 2016, the Mayor and Council of the City of South Tucson passed Ordinance No. 16-04 which included several sales tax rate increases. These increases are effective October 1, 2016: